If you are thinking about becoming a homeowner but do not quite know where to begin, below is an overview of the different options that are available to you. Embarking on a property owning journey can seem daunting at first, but as long as you research properly, you will be able to navigate the process successfully.

If you’re more of a ‘listener’ than a ‘reader’, then this video summarises the information in this blog. If you’re a reader, continue on reading below.

THE TYPICAL PROCESS

The usual way to find and buy a home involves Estate Agents. Homeowners pay estate agents to advertise their home and find a buyer for them. If you are looking for a property to buy, an estate agent would be your first point of call. Although they do still have their agencies on the high street with pictures of properties to purchase in the window, the easiest way to see what is on offer is by using a real estate search engine. Estate agents use websites like Rightmove, Zoopla or On The Market, for example, to advertise the properties that they are selling. You can then go through a wide range of properties on offer from various estate agents and search by location, area or size of property etc.

Once you see a property you like, you can then go and view it to make sure you are happy with it before making an offer on it. Estate agents will want to see an Agreement in Principle and proof of your deposit before they will accept your offer, as they need to know that you are serious. If your offer is accepted by the property’s owner, you can formally apply for your mortgage and instruct a solicitor to deal with your purchase. The solicitor will then lead you all the way through Exchange of Contracts (which is the point of no return as it is legally binding) to Completion (the day you get the keys and can move in).

IF YOUR FEELING RISKY

Auctions are another way that you can find and acquire a property but it definitely is not for someone who doesn’t know what they are doing. The types of properties you may find at auctions are refurbishment or (re)development projects, properties that are hard to sell on (for example if they are unmortgageable and need a ‘cash buyer’), or mixed use properties. This list isn’t exhaustive – you can also pick up ‘normal’ properties at auction and as services continue to move with technology and become more online based, you can find a wider variety of properties that are being sold by modern method of auction as well.

Guide prices for auctions can look very appealing, but they are only indications of where the reserve price will fall (not more than 10% higher than the guide price). A property that seems like a fabulous deal may end up being sold for a much higher price depending on the competition. To get an idea of what a property is likely to go for, it is best to do research on the property itself to see whether it has been auctioned before or whether any properties similar to it have previously been sold at auction.

Before going to an auction, there is other research that you need to do. If you do not read the terms and conditions (which are subject to change up until the day before the auction) then you could get stuck with undesirable conditions, such as being lumbered with paying off someone else’s debt. If you are not confident with buying a property at auction (or even if you are) it is a good idea to instruct a solicitor to go over the legal pack and point out anything that looks dodgy.

Another way in which auctions are risky, is that sometimes you may not have proper access to a property beforehand. This happens especially if it is unsafe to enter and this could mean that you are unable to do a proper valuation on the works that need doing. The consequence of this is that you could end up with a building that is worse than you anticipated, more costly to restore and so less profitable.

One of the good things about property auctions is that the process of buying is so much quicker than the typical process. This is almost like a double-edged sword though, as the deposit for the property (10%) is payable on the day of the auction and then completion is usually done within a month or so. The key thing to be aware of is that exchange of contracts happens as soon as the gavel hits the sound block at the auction. If you are the highest bidder, you are immediately legally obligated to purchase that property, so you really need to make sure that you are in a position to complete within a short amount of time. Your finances HAVE to be in order.

A HELPING HAND

The ‘Help to Buy’ scheme was launched in 2013 in a bid to help first-time (and other) buyers get onto the property ladder. Under this scheme, homebuyers only need to have a 5% deposit as the government is wiling to loan you 20% (40% in London) of the property price. The idea is that mortgages become more obtainable as buyers would only need to qualify for a 75% (55% in London) mortgage from a lender. As with most things, there are a few catches…

- The property must be a new build

- The property must be up to the value of £600,000

- You cannot have any additional properties

- The government loan is interest free for 5 years only. After this period, interest is charged.

- The government takes its share of the profit if you sell on

This scheme is beneficial to those who like the idea of having a new home, but, there are also downsides. With new builds, you need to pay attention to the service charges that you will pay. A service charge is typical of a leasehold property (usually flats are leasehold), however, new build homes that are freehold also tend to come with a service charge. This service charge is usually to fund the maintenance and upkeep of the roads, parks and other shared areas on the housing development. This is because the council do not want responsibility for them. Sometimes, the service charge prices change after a year or so and can become quite unaffordable (depending on the company who takes over the contract). Some homeowners have struggled to sell on their home, because the hike in the cost of the service charge was so unaffordable to potential buyers. Developers are now looking at alternative ways to cover service charges, for example at the development in Ebbsfleet, Kent, they are looking at building social spaces such as cafes that can generate a profit and then fund some of the maintenance.

The Help to Buy scheme is available from house building companies, such as Barratt Homes, Redrow, Bellway etc, so you will need to approach them directly. You will find lots of different companies will offer incentives to encourage you to buy from them, such as paid stamp duty or help with selling your existing home.

If you are looking to utilise this scheme, research well into both the terms and conditions of the scheme and the different house builders available in a particular area. Make sure that you feel comfortable and are getting a high quality home at good value for money.

SHARING THE LOAD

‘Shared Ownership’ is another scheme that is available to buyers and as the name suggests, you can choose to own a share of a home e.g. 25 or 50% instead of the whole property. If you own, for example, 25% of a home through shared ownership, then you will be paying rent on 75% of it. This means that monthly outgoings tend to be very high and as a result it is hard to qualify for shared ownership. You need to be able to prove that the monthly costs are affordable according to your income. You can purchase more of the property as you can afford it, which will bring monthly payments down over time.

As shared ownership is a housing association scheme, priority is given to housing association tenants, the local authority and sometimes key workers, which again makes it hard to get yourself on a list with a housing association. As with Help to Buy, shared ownership is only available on new build properties and you cannot have a second home.

Make sure you properly research into this scheme, as shared ownership can sometimes keep you in the same kind of ‘money pit’ cycle that renting does. The total monthly outgoing of mortgage payments, plus rent can be very high. You could potentially find a place to rent for less and then with the money you save, put it towards a deposit for something you own 100% of. Although property appreciates over time, new build properties on average do not see the gains that existing properties do and so in the short term, it may not be profitable. Having said that, there are of course lots of people out there who have benefitted from shared ownership and have managed to own their property outright by being frugal.

CLAIMING YOUR RIGHTS

The Right to Buy scheme is solely for council tenants and enables them to buy their council home at a calculated, discounted price. These discounts are quite significant, as the maximum discount you can get is £84,200 (or up to £112,300 in London boroughs). The discount you get depends on the type of property you are living in and the number of years you have lived there for.

As with any of the other schemes, there are conditions that need to be met, such as, you need to have been living in the property for at least three years. If you purchase a home under this scheme, then you will need to be mindful of the fact that if you sell the house on within 5 years you may have to pay back all or some of the discount.

If your council home was transferred to a housing association or you were moved into a different property, you can look into the Preserved Right to Buy scheme which offers discounts up to £78,600 (or up to £104,900 in London).

The ‘Right to Acquire’ scheme is similar, but is just for housing association tenants who have rented from public sector landlords for three years. Public sector landlords include:

- housing associations

- councils

- the armed services

- NHS trusts and foundation trusts

Again, there are clauses, for example, the property needs to have been built or bought by a housing association or local council from 1st April 1997 onwards and you cannot use this scheme if you are a council tenant. Through this scheme, housing association tenants can purchase their home for discounts between £9,000 and £16,000 depending on where the property is located.

TESTING THE WATERS

Rent to Own is something to be considered if you are not ready to commit to buying a property and would like some time to transition from renting to buying. Under this scheme, you would be able to live in a new build property for between five to seven years (depends on the housing association), paying 80% of the market rental rate. Between the end of the second year and the end of the term, you would be able to buy the property outright, or buy part of it through Shared Ownership. If you have changed your mind about purchasing that particular property, you can move out of the property after five-seven years. Some housing associations will allow you to stay for longer, but again, it depends on the company.

The benefits of this scheme are that you get to live in a new property for a lower than typical rent. This is particularly helpful if you are set on living in a particular area but cannot afford market prices. The savings you make on the rent can then go towards a deposit for the property later down the line. When you are ready to purchase the property, you get 25% of the rent you’ve paid back. In addition to this, you get 50% of the increase in the property’s value, which again can go towards the deposit.

The disadvantage of this scheme, is that it is not as common as the other schemes and so is more competitive. Your household also has to be earning £60,000 per year or less, you have to have a good credit history and you cannot have other properties. Different housing associations offer different things so it is always good to seek advice so that you make the best choice possible.

WHY BUY WHEN YOU CAN DIY?

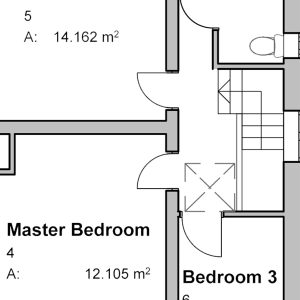

If you can’t find what you want on the property market and you want something new and bespoke then Self Build is definitely the way to go. This is obviously the most onerous way of owning a home, as you have to source and buy the land before embarking on the building process. If you are not confident in starting from scratch on a self build project, you can look for land that already has planning permission in place – eliminating the need for you to hire an architect to draw up plans. This obviously makes the project less bespoke (to you), however, the process of obtaining planning permission takes time, effort and know-how, so it is worth avoiding if you do not already have a ‘grand design’ in mind. Another disadvantage to this method, is that land has increased significantly in value over the years, is a hot commodity and/or may not be freely available in the location that you want to live. The upside to self builds is that you could potentially get something that is, overall, less costly than buying a building that already exists. This means that you will (typically) instantly make a profit once the project is complete. There is plenty of support out there in the form of land finders, architects, project managers etc to help you through a self build project, so that you can create the home of your dreams.

The method you choose to use to buy a house depends on a wide range of factors, such as finance, experience and non-negotiable things you want in a property. Whichever route you take, make sure that you have properly researched your options and that you understand the terms and conditions. Owning a property (especially if you need a mortgage) is a serious financial obligation; not keeping up with the payments on a property can have serious consequences. If you are particularly drawn to a method, try to find someone (preferably that you know) who has used that method to purchase or build a house already. They may be able to share their experience with you and give you more information from a practical point of view.

The important thing is to take time enjoy the process of finding a home, as although it can be stressful at times, it is a very rewarding in the end and you learn a great deal along the way.